Definition and Impact of Inflation

Niklaus F. Gerspach

Table of Contents

Approaches to reduce inflation

Can the Money supply be used for real economic growth?

Definition of Inflation by Ludwig van Mises

Release 2, dated 15. August 2024

Niklaus F. Gerspach

Introduction

Since economics was officially invented about 250 years ago, the term inflation has been subject to research ever since. However, the issue has been around for much longer. Dionysios I. von Syracuse, a Greek dictator living in Sicily, had already borrowed so much money that he found a way not to pay back all his debt. He collected all one drachma coin in circulation, and had a value of 2 stamped on each coin, by order. This example has been repeated up to the present day. It started to be institutionalized in 1694 when the first central bank in England was created. They institutionalized and made money a monopolistic state affair marking the beginning of inflation.

Other countries like Japan, Switzerland and FED created their central banks in 1882, 1907, and 1913 respectively. However, money existed much longer and was not owned by these monopolists for a long time. Its main aim of invention was to cut down on transaction costs, which went up when someone only had a cow and needed some shoes. One had no choice but to buy 1,000 shoes against the cow. There was also a challenge of finding a double coincidence of wants. When money became monopolistic state-owned, other challenges emerged: no competition, no choices of money, and no real visible evidence of what governments are doing with the money. Governments systematically reduce money’s value by printing more money to purchase goods and services or pay for their debt services. Another leverage to control money is the interest rate. Central banks reduce interest rates, which is good for large debt holders like states but bad for consumers because they earn little or no interest on their savings. Savings is key for creating capital needed elsewhere. Every good is in short supply, but this is different with government money. However, cryptocurrencies demonstrate that competition is possible.

Government debt funding for governmental spending has always ended in a decay of the money system. Fall of 1923, the Reichsbank of the republic of Weimar financed the largest part of the government’s expenses with printed funds. This led to hyperinflation, with prices increasing hourly. You may have seen recent newspaper photos showing piles and bundles of printed bank notes, which were about to be put into stoves because they were not worth anything anymore.

Methodology

Over the years, I have been reading in the press, mainly as a hobby, about inflation. Consequently, I am documenting here what I have learned, define inflation, and summarize the factors I encountered. Thereafter, I described some scenarios and how governments use inflation to their advantage. Lastly, I illustrated several ways of mitigating inflation and preventing its occurrence. This paper is a summary paper and not a research document, written from an economist, destined at a non-economist audience. I am not attached to any research institute or part of the educational system, writing simply for pleasure. Nevertheless, to give credit to authors, if their names were stated in newspapers, I have added all articles in Appendix .

Definition

Inflation refers to a ballooning quantity of money with no corresponding higher supply of goods. The Austrians call it simply an increase in unbacked money supply. It is an increase in the national price level and not an increase in the price of a specific type of good or service. Therefore, the immediate result is a reduction of purchasing power of money (salary, cash, and in your bank account). According to Milton Friedman and Anna Jacobson Schwartz, an increase in money supply (M2, M3, or M4) relative to the production of goods and services induces an increase in prices. The two economists have come up with the most convincing and reliable empirical evidence between the autonomous influence of money as the cause and as an effect (price increases).

The cost of a basket of goods and services measures inflation. Many goods should be included in the calculations. For instance, assets like buildings and financial products like stocks and bonds.

The definition by Ludwig von Mises in his work Human Action has been added in the Appendix.

USD an example

US dollar in August 1971 had the same purchasing power as 7.66 USD in March 2024. Conversely, the purchasing power of a dollar today is equivalent to only 13 cents in 1971. This means that the U.S. dollar has been devalued by an average of nearly 4% per year relative to the common consumer goods of American households for more than half a century. One can say the same thing about the euro since 1999. The average inflation amounted to about 2% per year. Parallel real estate and stock exchange were equally inflated, without that, this was considered in the official statistics of inflation. In France, the price of real estate has tripled, in Germany it has doubled.

Factors causing inflation

- Increase in the quantity of money, such as M1 and M2, etc.

- Volatility or speed of money circulating in the economy, measured by dividing GDP by M2.

- Y or Q is GDP, the output of an economy in terms of goods and services.

- Prices of goods and services, including salaries as the price of labor and interest rates as the prices of money.

- Spending for consumption and investments is known as Keynesianism.

- Increase or decrease in debt, both public and private.

- Interdependencies of prices, as all prices are connected through the market economy.

- Globalization.

- Expectations, trust, and credibility.

- Amounts of credit taken.

- Decarbonization.

- Demography is an increase or decrease in the labor supply in an economy.

- Technological progress.

- The yield of bonds and other financial products, the decoupling of the financial market from the real product and service market, and the dominance of a financial services and product market.

- Level of employment and economic growth (of GDP).

- A relative rare phenomenon: Profit Margin Inflation.

- Monetary and fiscal policy direction.

- Value of the local currency.

A word of humbleness about economics: economic theory cannot explain reality (although some economists claim it can) because reality is too complex, volatile, uncertain, and ambiguous (VUCA). However, economics can describe and forecast patterns. For example, if Iran and Iraq go to war with Saudi Arabia, there will be a shortage of crude oil supply. As a result, prices for crude oil will go up in the short term due to an increase in demand and a decrease in supply. It should be noted that such incidents most likely trigger other economic and non-economic factors apart from price increases of commodities. Thus, the output of the complex system entailing the interaction of different interdependent factors over a long period cannot be fully explained economically.

Connected Scenarios

This paper is based on Kopernikus, and David Hume’s economic theory, the quantity theory of money, as elaborated by Irving Fisher. This theory can be simply explained by the following equation.

M * V = Q * P

This equation says: the change of the amount of money available (M) times the speed or volatility, how quickly the money circulates (V) has an impact on the level of GDP short term (Q) evaluated by the prices (P). Purely mathematically, when the price level increases, the money supply increases. But how?

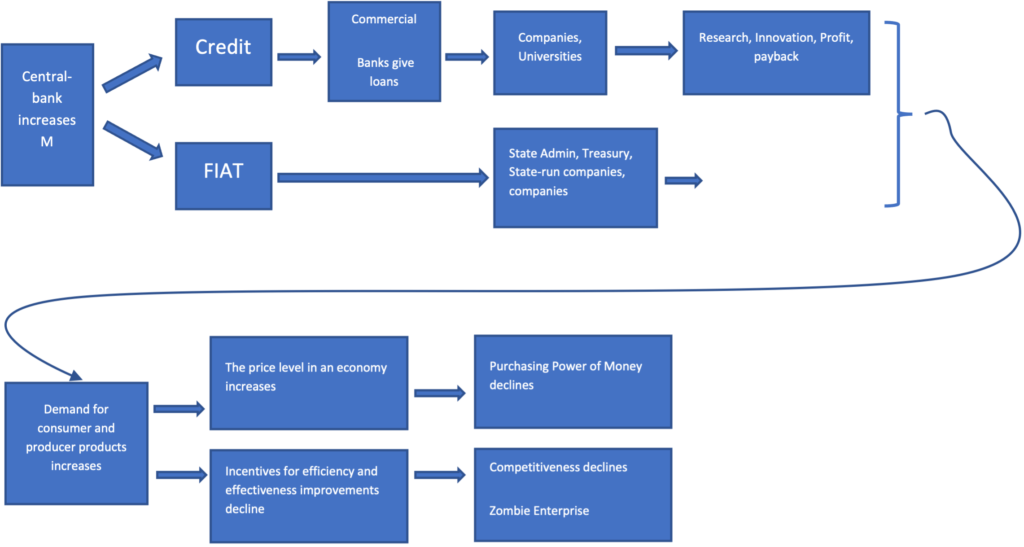

Central banks purchase government bonds from the Treasury or governments’ finance departments through commercial banks. In other words, the Central bank pays with money. Since the financial crisis of 2007/2008, Central banks have been crediting these bonds on the asset side of their balance sheets (in the press, you could read there is a ballooning of the balance sheet of central banks). From a liability perspective, central banks debit the equivalent bond value to commercial banks. To achieve this, each commercial bank must have an account at the central bank where the money (from the central bank) is booked. In principle, the central bank replaces papers in the private sector with its liquidity, which ends up on the balance sheet of the commercial private banks. This has been called QE quantitative easing, which increases both the balance sheet of the central bank and the commercial banks.

So far so good, if the money remains there, nothing changes resulting in the absence of inflation. Between 2008 and 2021, there was no inflation despite lots of money supply out there. This is because the money was parked instead of being spent. It is like keeping your banknotes underneath your bed. In other words, the volatility of money was close to zero since there was minimal money circulation during that period.

In 2020 an outbreak of Covid-19 originated in China towards the end of 2019. This disease became a global pandemic and negatively impacted the economy. Companies drifted into financial difficulties because they couldn’t produce products. Consequently, there are minimal sales, people lost their jobs, and immediate purchases of PC, and toilet paper, resulting in a supply chock. In Switzerland, the banks made cash available (yes, commercial banks create 90% of the money supply) and gave credit to the government, which gave these credits to companies, unemployment payments, and so forth. In many countries across the globe, governments initiated crediting programs to increase the purchasing power of citizens. As the purchasing power increased, there was also an increase in demand for commodities, which were already scarce due to low production during the lockdown. The trigger of inflation during this period was an increase in the money supply that was spent on the real economy of goods and services. Due to increased purchasing power, one could purchase more commodities than one could before the initiation of credits. Retail skyrocketed after Trump gave everybody cash during Covid. In other words, there was an increase in the second and the sixth factors in the above list.

Weimar’s Reichsbank is a good example of the above since 1923; it financed all government spending by printing new currencies. This strategy led to hyperinflation and unemployment; thus, Hitler gained power in 1933. He fixed the unemployment problem with the same tool that caused the problem, printing money to finance the war industry. My dad informed me that Hitler’s strategy of using money to finance war created a giant demand for manpower, including all women. In addition, a scientific research article alleges that excessive fiscal spending was the main cause of the demise of the Roman Empire. This paragraph has expounded on the first up to the sixth factors listed on the second page.

On the 24th of February 2022, fear and the risk of an energy supply shortage increased. This supply shortage caused prices to rise in the short term, a phenomenon known as overshooting, which could be clearly seen in the gas prices. By late 2022, however, the stocks were filled, and the free independent nations and large corporations acted together (through the invisible hand of Adam Smith) to find solutions (without intervention from the government or Mr Putin). This is a good illustration of factor 7 (interdependence of prices). Putin’s aggressive behavior led to an increase in gas prices, oil prices, coal prices, and LNG prices. As a result, the world is becoming more aware of what goods require gas. Everyone is eager to switch to electricity, causing electricity prices to rise, as well as the cost of the equipment and capital needed to produce electricity. This phenomenon is virtually global now, which is point 8 in the list provided on the second page.

Price increases are bad news for Mr and Mrs Ordinary, as they cause the population to lose trust and confidence, expecting prices to keep rising. This issue is putting social cohesion and peace in danger. Consequently, citizens often vote for right-wing parties, as they promise to resolve the issue through increased fiscal spending. This is how Hitler, Trump, Putin, Erdoğan, and Bolsonaro all gained power.

Approach #2 Banking Theory, Keynes

The money supply increase generally results in lower interest rates, as the cost of money. However, negative interest rates were introduced, whereby one pays to keep money in their bank account. This incentivizes people to invest their funds elsewhere. Wealthy individuals, investment companies, and pension funds with substantial capital can easily invest or request loans from banks. This is because they have considerable collateral. These funds are then pumped into the global stock and housing markets, leading to a rise in their prices and affecting currencies. This has been taking place over the past fifteen years and is evident in the continuing growth of stock market indices and rising house prices. This is called asset inflation, which adversely affects the average household, which cannot afford to purchase a house due to the increased prices. This is an example of inflation, since the number of houses and land does not increase, only the prices do. This illustrates the reduction in purchasing power. For example, if you own €100,000 in your bank account, and a house costs €100,000, inflation can cause the house price to rise to €150,000. This means that the individual cannot purchase the house on their own. The additional problem is that asset price inflation must be considered when calculating inflation. This brings up another issue: the price has an essential coordination and information function. Prices provide decentralized information about the availability and scarcity of resources, goods, and services. This is why government price fixing; price caps and minimum prices are discouraged. An example of this is the milk powder issue in the US in mid-2022. To conclude, mature character should not be tampered with. This is the tenth point in the list provided on the second page of this document.

The increasing cost of gas has led to an increased demand for electricity, resulting in more carbon dioxide emissions. This poses a challenge in terms of developing new energy sources, such as wind, solar, tide wave, geothermic, and hydrogen. These energy sources are expensive and not always available when and where consumers need them, causing prices to rise further.

Assuming all economies benefit from full employment (unemployment below 3 percent) and high economic growth (factor no 15), inflation is highly likely. This is because salaries would go up, which is a major component of the cost of companies. This would lead to a wage-price spiral, compounded by the opposite of factor no 8, which is deglobalization. With fewer cheap goods from Asia and more expensive goods from national manufacturers, customers would ultimately be the ones to bear the burden.

A rarer case is factor no 16. As the Bank of England and the University of Massachusetts Amherst researched, companies pass on price increases to customers and retain the high price levels, even as commodity prices and other costs go down.

The last factor I want to talk about is 18. An exchange rate is a price of one currency to another currency. So, inflation affects that exchange rate too. For example, the Euro and the USD (where inflation is higher) became a rounded two fifths weaker towards the Swiss Franc since the turn of the century. If I kept 100 USDs in a Swiss bank account since 2000, it is 40 USD less worth. The Argentinian Peso lost 99% of its value.

Abuse and Risks

Governments finance a large part of their current expenditure (including paying interest on government debt, which is already higher than tax revenue) by asking their Central Banks to print fresh money. This is done today with computers and a click of a mouse to book money into those accounts. This type of money is called FIAT money (see the definition in Appendix 3).

When Central Banks keep interest rates low and buy bonds and other papers, governments have a reduced incentive to balance expenses with tax revenue. This is known as a balanced budget. If a private company or individual fails to do so, they must declare bankruptcy. However, the law is different for governments. This reduces trust in governmental institutions, as mentioned above. In addition, governments have no incentive to reduce spending because money is free and abundant.

Governments also have no incentive to repay debt. Existing debt has a nominal value, but if the value of the local economy’s currency declines, then the government’s debt also declines. This was famously done by Dionysios I. von Syrakus. No state has ever repaid its debt because the state is always the biggest profiteer: The entire war debt of 164 Billion Mark amounted to 16.4 Pfennig (cents in the currency of Mark at the time) after the currency reform end of 1923.[1]

If Central Banks stop buying new debt papers and bonds, the risk is high that long-term interest rates would rise. This is because the market determines long-term interest rates through market arbitrage (not the Central Bank setting interest rates in the short range). The market would interpret such an action as reducing fiscal policy (government spending); in other words, governments would spend less. Due to its size and weight in the economies of many nations (sometimes more than half of GDP), this would be interpreted as a risk of shrinking growth. Holders of long-term papers, which are tradable, would sell them because they expect less growth, less consumption, less wealth and lower prices of papers, thus taking a profit. This is illustrated in a mathematical example in Appendix 1.

If now Central banks start increasing short-term interest rates (factor no 4), as happening since 2022, those companies tight with liquidity and high debt, have a cost problem, since the interest payment for their debt increases. They then go to the banks, which might occur as a bank rush for certain industries, like the tech companies in California. Those banks usually invest in “save” long-term bonds, which have higher interest rates. After these banks sell off their short-term investments, they must sell off their long-term papers (assets). Since interest rates have gone up eventually, the price of these assets has gone down (exact scenario is explained on page 18), so these banks need to sell these papers at a loss because they need to give their customers their money back. Banks have a liquidity and a solvency problem. So, this causes stress to the banking system. And here we go, too big to fail, and we are back in socialism where the state needs to step in with taxpayers’ money and more debt to rescue these banks. A really true scenario occurred with the Silicon Valley bank in March 2023.

10 year T bonds yield have now the highest level (August 2023) since the last 20 years. Three factors that drive inflation as discussed below in this paper: Declining globalization, enormous fiscal spending of the Biden government; therefore more bonds are issued, therefore higher interest rates to make these bonds attractive, therefore the interest payments of government increase.Another factor to push inflation is factor 12: Demography. Well described by Manoj Pradhan. He explains in his book “The great Demographic Reversal” Globalization over the past two decades has provided access to more and cheaper labor, especially after 1990 with the opening of Eastern Europe after the wall and Asia. Parallel salary increases were modest in the western world. This has capped Inflation at low levels. Pradhan and his cowriter Goodhart forecast a change because labor supply is decreasing in China, Easter Europe, Europe. This will create a shortage of labor coupled with declining globalization, trade wars and so on. Which will reduce the supply of labor at lower costs even more. Therefore, pressure for higher wages will increase in every industry, fewer workers need to pay the social security of the growing older population. Migration is politically unacceptable in most countries to resolve that problem. Governments in those countries who have a low childbirth rate and who want to increase debt to maintain fiscal spending are under financial market watch and do not last very long, which the example of UK Prime Minister Liz Truss has proven. As a result, interest rates for these countries go up, costs go up and therefore inflation will go up, due to the huge state spending quota of most economies.

Parallel Decrease of Interest Rates

Central banks lower their interest rates to control money demand in parallel to the above measures. This results in a savings decline, the value of wealth decline, and the costs of investments and credit decline. Credit loans are then utilized to run companies, prompting individuals to increase their consumption through cheap loans. Prices could then increase, triggering inflation due to State Fiscal Policy financed with FIAT money. This is nothing else than the central bank directly financing the government’s debt, which is done by the US, EU, China and other high inflationary countries.

Why is inflation bad?

Inflation distorts product and service pricing due to the relation of prices previously described. Wealthy corporations and individuals can afford to buy houses, yet the middle-class population cannot. In other words, with inflation it becomes a lot more attractive for an investor to buy existing assets compared to invest the same amount of money into development and production of new assets. This goes hand in hand with the likelihood of less emergence of innovation. In other words, productive investments are more and more replaced with speculative investments which aim to increase the price. This is not a fault of capitalism; rather, it is due to the government. Therefore, criticizing capitalism is not justified.

The second main negative impact is that inflation increases inequality. Inflation is bad news for those who are saving money, reducing consumption for their children, or planning to buy a house in the future. For example, if inflation is 10%, then their savings would be worth 50% less after seven years. Those who have already a lot of wealth can request easily more bank loans. Since they have a lot of real estate or other assets, the banking system will give them much more voluntarily an additional loan to buy even more assets like houses or stocks, which then increases the chances for incremental revenue even more. Either by cashing in the sale of real estate a few years later that has increased in value (due to inflation) or obtaining additional revenue by renting the real estate. The ordinary man will never receive an equal percentage increase in their paycheck to make up for this percentage increase in wealth and income of the wealthy people.

The third main negative impact: Inflation also reduces the real value of debt for those with high levels of debt, such as governments; consequently, they receive good news.

The fourth main negative impact, it gives rise to discontent. For the ordinary average employee without any existing assets, an increase in social status becomes more and more difficult, facing a disproportionate inflation of asset prices. This has a negative impact on social cohesion in society. Somebody can become rich without really doing anything from the viewpoint of the average, ordinary man. This is a situation which many people perceive intuitively which generates jealousy, unhappiness and discontent. And this general feeling is held against anybody, even those entrepreneurs who do work and generate wealth. The problem is: It is often impossible to distinguish where the wealth is coming from, whether it’s coming from a productive activity or whether it’s coming from a redistribution of inflation. Auto destructive forces reach finally their effect in politics, by voting autocrats and right wing. In other words, inflation destroys trust in governments and financial stability and in democracy.

Above four main consequences are well described in more details by Karl-Friedrich Israel.

In addition, inflation also has other negative implications. It increases the cost of living, reduces consumption and the value of investments, and erodes the purchasing power of individuals. Inflation can also lead to increased unemployment, as businesses cannot afford to pay their employees the same wages due to rising costs.

Approaches to reduce inflation

As Raghuram Rajan wrote recently, abandon the resistance to see monetary policy as the root cause of inflation, instead of desperately blaming everything else as the cause. AS Switzerland did after the first world war around 1923: Politics need to declare and execute a clear will, desire to plan, find and execute a return to financial and monetary stability in an economy. This creates the ground for new trust in a currency and a renewed stability. In other words, reduces inflation.

Inflation is a monetary phenomenon that can only be reduced by utilizing monetary means. Central Banks can reduce their money supply by selling the assets they possess, rather than simply printing more money. However, if they sell too much, the price of these bonds can decrease, and the interest rates of these bonds can increase due to their tradability and fixed interest rate payment. This can put Central Banks in a difficult situation.

It is important to ensure a clear separation between fiscal and monetary policy to address this. Additionally, Central Banks should be independent in both Action and reality and should refrain from purchasing government bonds from their local Treasury department. True independence of central banks is however wishful thinking, as the first Chief Economist of the European Central Bank Otmar Issing admitted during the 17th Gottfried-von-Haberler-Konferenz “Taking Money out of Politics” in Vaduz. Up to now, no rules were found, that would protect the central bank from political influence and politicization of responsible central bankers.

Central Banks should focus on stabilizing their local money rather than attempting to resolve structural issues. This is important in supporting their citizens, as a stable and reliable currency is necessary for economic development. A stable currency encourages investment, leading to economic growth, job creation, and improved living standards. Additionally, a stable currency can also protect citizens from inflation, which can erode the value of their savings.

It is also essential to reduce the state quota of GDP. Private companies are better equipped to provide services and products that are more effective and efficient than state-run companies. This order of a market economy with private players can reduce the pressure of inflation.

Globalization can also reduce price pressure from suppliers by enabling the free circulation of the best goods at the lowest possible price, without import duties or restrictions, or trade wars. This increases competition between companies, which is a discovery method for the best solutions for customers.

Additionally, the number of workers is declining in many areas, which can add to price pressure due to wages, as the number of workers decreases, the competition for labor and salary pressure increases.

To protect against inflation, people can buy gold, spend now on commodities, or purchase inflation-protected financial products. Gold is a reliable hedge against inflation and has been used as such for centuries. Additionally, spending now on commodities can be an effective way to protect against inflation, as the prices of these goods will increase with inflation. Finally, inflation-protected financial products, such as Treasury Inflation-Protected Securities (TIPS), are designed to adjust with inflation, so investors can maintain the value of their money over time.

Lastly, Competition: As Friedrich August von Hayek proposed in his book “Denationalization of Money” in the 1970s, that private and state Currency Competition leads to stability of money and Discipline, the emergence of cryptocurrencies is working towards this proposal. Despite its rocky evolution, these will not go away. Cryptocurrencies are becoming more popular as they offer a degree of anonymity, are secure and are largely immune to inflation. However, as they exist outside of government control, it is important for governments to regulate these to ensure they are not used for money laundering or other illegal activities. Additionally, regulation can help protect consumers and ensure the currency’s stability. Bottom line to me is that competition of gold, cryptocurrencies, and state currencies within a legal framework with a maximum of liberty to drive innovation in this field may be the medium and long-term solution.

One thing that does not work on its own is when politicians promise that they will reduce inflation as a promise if citizen voters elect them.

Can the Money supply be used for real economic growth?

The Money supply can be used for real economic growth. This money would be made accessible through commercial banks, or even better, through tax breaks, reductions, or grants to universities for research. This is called technology neutral or agnostic. Entrepreneurs, large companies, startups, and small business owners could apply these benefits to find and test sustainable solutions for technology development, such as green hydrogen and solar technology or fostering innovation of energy transport technology. With this cheap money, companies could compete, and the best solutions would win the trust and purchase of individuals and companies in need of this technology at the best possible price, ultimately helping the environment.

This should not be confused with the EU telling the industry to stop all diesel engine production by 2035. Here, the government-like organization decides what to do from the top and tells business owners what to do. In other words, the EU is interfering and becoming an economic player with orthodox, dictatorship-like behavior.

Conclusions

Central Banks flooded the market with a substantial amount of money after 2008, which has since been trickling into the economy, leading to a surge in prices across the globe. Governments worldwide have been the primary players in this regard by implementing fiscal policies of spending, providing citizens with money (including the wealthy), and offering subsidies to the population.

If governments and central banks do not take effective measures, inflation is likely to increase, resulting in a decline in the wealth of all individuals. Zombie companies may then continue to grow, leading to further wealth disparities, wherein the rich become richer, the middle class poorer, and the poor even poorer.

Moreover, with the passage of time, money tends to lose its value. Fortunately, people are creative and have created alternative currencies, such as cryptocurrencies. Despite the current issues, it is believed that cryptocurrencies will have a promising future.

To counter inflationary expectations and already existing high inflation in the US and Germany, the only viable solution is to raise the interest rates and reduce the money supply by selling the bonds that the central banks acquire. This would lead to a decrease in the money supply, thus preventing inflation.

Appendix

Bonds and interest rates

The relationship between interest rates and bonds is a complex one. When interest rates rise, bond prices may decline as investors seek higher returns on their investments. This means that if interest rates increase, the same bond may be worth less than when it was initially purchased. For example, if an investor purchased a bond with a face value of 1000 USD and an interest rate of 10%, they would receive 100 USD in interest payments each year. However, if the interest rate rose to 20% a month before the investor sold their bond, the bond would now only be worth 500 USD, yet the interest payments would remain the same at 100 USD. This highlights the importance of monitoring interest rate trends when investing in bonds.

Scenario: When inflation expectations rise, the prices of Treasury bonds (T-bonds) typically decrease, and their yields rise. Here’s the reasoning behind this market behavior:

Relationship Between Bonds and Inflation

- Fixed Income vs. Purchasing Power: T-bonds pay a fixed interest (coupon) over time. When inflation expectations rise, the purchasing power of these fixed payments diminishes. Investors demand higher yields to compensate for this loss in value.

- Price-Yield Inverse Relationship: The yield on a bond moves inversely to its price. When yields rise (to reflect higher inflation expectations), the market price of the bond falls.

Logic of Market Participants

- Rational Investors Seek Higher Returns:

- When inflation is expected to rise, investors seek bonds offering higher yields to outpace inflation.

- They may sell existing lower-yield T-bonds, causing their prices to drop and yields to rise.

- Competition With Other Investments:

- Rising inflation often leads central banks to raise interest rates to combat inflation.

- Higher interest rates make newly issued bonds more attractive than older bonds with lower yields, reducing demand for existing bonds and lowering their prices.

- Perception of Real Return:

- The « real return » on a bond is its nominal yield minus inflation. If inflation expectations rise while a bond’s nominal yield remains fixed, its real return decreases, making it less attractive to investors.

Exceptions to the Rule

The only scenario where T-bond prices might increase during inflationary pressures is if a flight to safety occurs:

- For example, if geopolitical risks or market crashes make investors prioritize security over returns, they may buy T-bonds despite higher inflation expectations.

Definition of Inflation by Ludwig van Mises:

In popular, non-scientific usage, a large increase in the quantity of money in the broader sense, which results in a decline in the purchasing power of the money unit, distorts economic calculation and diminishes the value of accounting for measuring profits and losses. Inflation affects prices, wage rates, and interest rates at different times and in varying degrees, altering consumption, investment, production, and the structure of business and industry while increasing the wealth and income of some and reducing that of others. Inflation does not increase the available consumable wealth; rather, it rearranges purchasing power by granting some to those who receive the new money first.

This popular definition of inflation, while useful for history and politics, lacks precision in scientific terms, since the distinction between a small increase and a large increase in the quantity of money is indefinite, and the differences in their effects are largely a matter of degree. For theoretical analysis, a more precise concept is any increase in the quantity of money in the broader sense, which is not offset by a corresponding increase in the need for money, thus causing a decrease in the objective exchange value (purchasing power) of money. Source: Human Action from von Mises.

The currently popular fashion of defining inflation by one of its effects, namely higher prices, conceals from the public the other effects of an increase in the quantity of money, should the resulting rise in prices be offset by a corresponding decline in prices due to an increase in production. Using this definition weakens opposition to further increases in the quantity of money by political fiat or manipulation, permitting greater distortion of the economic structure before the eventual readjustment, popularly known as recession or depression. The above and more information on the content above is on Page 949 of Volume 4 of Human Action from von Mises.

Fiat money:

A coin or piece of paper of nominal commodity value declared by the government to be money and given the legal tender quality is known as Fiat money. This money neither represents nor is a claim for commodity money and is issued without any intention to redeem it; consequently, no reserves are set aside. The value of Fiat money rests solely on the acceptance of political law or fiat. Therefore, Fiat money is money in both the broader and narrower senses. This information is available on page 934, volume 4 of Human Action from von Mises.

Ludwig von Mises: “Human Action”. Liberty Fund Inc.

Milton Friedman, Anna Jacobson Schwartz: “A Monetary History of the United States”. Princeton University Press.

Harold James: Schockmomente. Eine Weltgeschichte von Inflation und Globalisierung. 1850 bis heute. Herder Verlag.

Mark Jones: 1923. Ein deutsches Traume. Propyläen-Verlag.

Karl-Friedrich Israel: https://kfisrael.com/publications/

Various “Check Up” Reports from the Reichmuth Bank

Articles in “Der Schweizer Monat” from

Roger Stettler

Peter Bernholz, no 1078

Alexandra Janssen

Matthias Binswangen

Articles in the “Neue Zürcher Zeitung” NZZ

2023

Christoph Gisiger, 16. July 2023, The Market NZZ. Interview with Raghuram Rajan

Rainer Hank 23. July 2022

Sebastian Bräuer.

Gunther Schnabl, 25. June 2019

Steve Hanke, 20. Mai 2021

Didier Rabattu, 11. September 2022

Albert Steck, 29. May 2022

Luca Schmid, 15. April 2023

Peter A. Fischer, 22. Mai 2023

Michael Ferber, 14. August 2023 about Economist Manoj Pradhan.

Ernst Baltensperger, Christoph A. Schaltegger, 15 November 1923

Dates of NZZ Articles without Authors or not recorded:

2022: 3. March, 7. May, 7., 9. September, 14. November, 17. November

2021: 29. January, 5. February, 17. February, 29 March, 26. April, 29. Mai, 26. June, 1. October,, 5. November, 1. November, 1. December

2020: 17. March, 20. June, 8. August, 7. September, 29. December

28. June 2014, 21. July 2014, 3. March 2010, 5. April 2011, 3. June 1994

Databases

Databases are used to draw my own conclusions based on facts and data.

U.S. Inflation Calculator, Eurostat, OECD, Bank of International Settlements, Bloomberg, World Bank.

Internet

http://www.libinst.ch/?i=institut–en Liberal Institute. Olivier Kessler.

Niklaus Gerspach

[1] Neue Zürcher Zeitung, Michael Rasch. 17. February 2023, page 23.